What are rates?

Rates are a property tax that people pay annually to their local council if they own a house or land. The money helps pay for the services, facilities and infrastructure needed by the community such as roads, parks, rubbish collection, and libraries. How rates are calculated is set out in the Local Government Act 1995 and the Valuation of Land Act 1978.

How does the Shire calculate the amount of rates revenue needed?

To calculate rates paid by individual property owners, the Shire must first determine the total amount of rates revenue needed. This is done by calculating the total operating costs minus income from other sources such as fees, charges or grant funding. The balance is the total amount of money that must be collected from all property owners in the Shire by charging rates.

How does the Shire calculate the amount of rates I need to pay?

In Western Australia, rates must be calculated by multiplying each property’s valuation multiplied by a differential ‘rate in the dollar’.

Your property’s valuation is determined by Landgate’s Valuer General’s Office, which is a separate organisation to the Shire of Augusta Margaret River. Depending on the predominant use of your property, Landgate will assign your property a ‘Gross Rental Value’ (GRV) or an ‘Unimproved Value’ (UV).

The rate in the dollar is set by council. We use a differential rating system, which means we charge different rates for different property categories, which are based on zoning and land use.

What is GRV?

Gross Rental Valuation (GRV) is the yearly income a property might reasonably be expected to generate if it was rented. The amount is influenced by factors such as age, size, date of construction, car shelters and pools.

GRVs are not set by the Shire. They are provided by the Valuer General which is WA’s statutory authority for working out how much land is worth across the state, as per the Valuation of Land Act 1978. (the VLA).

How often do GRVs change?

Every three years the Valuer General completes a revaluation of GRV properties in a local government area. The most recent valuation was undertaken in 2024 and will come into effect on 1 July 2025.

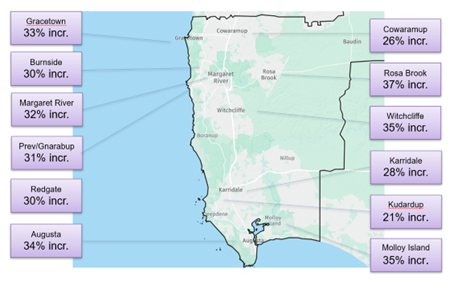

How have GRVs changed across the shire?

GRV valuations across our shire have increased 31%, which aligns with the current rental market conditions.

What is UV?

Unimproved Value (UV) is the fair market (sale) value of the property and is used to calculate rates for properties predominantly used for rural purposes. The UV valuation takes into account the value of the land only, and not any improvements on the land such as dwellings or sheds.

How often do UVs change?

The Valuer General completes a revaluation of UV properties annually. The most recent valuation was undertaken in August 2024 and will come into effect on 1 July 2025.

How have UVs changed across the shire?

UV valuations across our shire have increased by 9%.

How will property revaluations affect my rates in 2025/26?

If the increase in GRV and UV property values set by the Valuer General were passed directly on to ratepayers, the Shire’s overall rates revenue would increase by 28%, funded entirely by ratepayers through increases in their rates bills.

To offset the impact of the higher property values Council is being asked to consider reducing the differential rates in the dollar (the different rate amounts applied to each property type).

While rising operational costs mean we can’t fully absorb the increase, we’ve done our best to keep rate increases as modest as possible.

How much extra will I need to pay?

The increase per property will depend on the type of property you own and how much your individual property valuation (GRV or UV) has changed.

For the average residential household, the increase in rates will be around $2.83 a week, or $148 a year

We have also made some changes to our rating categories to bring them in line with the current legislation and streamline the administrative process, which could impact your rates. See What is the rating review?

What is the minimum rate?

A ‘minimum rate’ is set for each differential rating category. This is the lowest amount a ratepayer must pay to make a fair contribution to the cost of local government services and facilities, regardless of the value of their property.

This amount is set by Council, and under State legislation, less than 50% of ratepayers in any differential rating category can be charged the minimum rate.

Minimum rates are applied when the amount calculated by the rates formula is less than the minimum amount set for that category.

What’s the change to the Shire’s rate revenue overall?

The Shire’s overall rates revenue increasing by 4.9% which is the minimum amount needed to meet rising operational costs and ensure we can continue to fund the essential services our community expects and deserves. This 4.9% is on top of additional rates revenue generated from additional properties created during the past twelve months.

If the Shire receives extra rates revenue from new houses, does this mean our rate increase will be lower?

Rate increases are not reduced by additional revenue from property growth. While 308 new properties were created in the Shire last year, generating an additional $680,000 in rate revenue, property growth also increases costs. More homes mean more people using Shire services like libraries and recreation centres. Additionally, the Shire inherits the costs of maintaining infrastructure such as new roads, footpaths, and parks. Over the past two years, the Shire has taken on $27.9 million worth of developer-built assets, all of which require ongoing maintenance and eventual renewal by the Shire.

What are the Shire’s other sources of income?

Rates make up around 65% of the Shire’s income. To minimise rate payments, we work hard to generate revenue from other sources such as the Rec Centre entry fees and membership and capital grants and contributions.

As part of our ongoing advocacy efforts we’re urging the State and Federal Governments to review the local government funding model. Tourism is vital to our local and state economy, yet funding is based solely on our permanent population and doesn’t consider the extra demand high visitor numbers place on our infrastructure and services. We’re calling for great investment in our shire to maintain quality facilities for residents and visitors alike, and to support our growing role as a destination of choice.

What is the rating review?

The Shire of Augusta Margaret River has been working to improve our rating structure so it is simpler and fairer for everyone who lives in or does business in our community. We also want our rating system to better align with State government legislation and guidelines to streamline administrative processes.

The rating review will be implemented in ‘two-phases’ with the first phase of changes proposed to take effect as part of the 2025-26 rating year. Phase Two recommendations are proposed to be investigated further during 2025-26 for implementation in future rating years.

What is changing in 2025/26?

We’ve reduced the number of rating categories and made some changes to the minimum payment for Residential Vacant rating category in line with the Local Government Act 1995.

The new rating categories are shown below.

| 2025-26 Rating categories | 2024-2025 Rating categories |

|---|---|

| Residential | Residential Rural Residential |

| Residential vacant | Residential Vacant Rural Residential Vacant |

| Industrial, commercial, tourism | Industrial, commercial, tourism |

| UV rural | UV rural Strata Titled Vineyard |

| UV 1 | UV 1 |

| UV 2 | UV 2 |

| UV 3 | UV 3 |

| UV Conservation | UV Conservation |

What changes will be made in phase two?

Phase Two will consider split rates for properties that have both rural and non-rural uses and the rates for short stay holiday accommodation.

Implementing a split rating system is complex and resource-intensive, requiring both an additional FTE and support from Landgate—who have advised they won’t have capacity to provide indicative property values until at least 2026–27.

Any future changes to the rating of short-term rental accommodation would require further consultation and Council workshops, and if pursued, would not take effect before the 2026–27 rating year.

Are you increasing rates for holiday homes?

Currently, properties that have planning approval to operate as an unhosted short-term holiday rental are included in the Commercial, Industrial, Tourism rating category. The rate in the dollar for Commercial, Industrial, Tourism category is higher than the rate in the dollar for residential properties.

Residential = $0.081699 versus Industrial, commercial, tourism =$0.12212.

As part of ongoing rate review we will explore how hosted holiday homes are rated to ensure we level the playing field and keep things fair for everyone.

How was the review undertaken?

We used an external accounting firm, Moore Australia (WA) to review our existing rating structures and identify alternatives. Councillors and shire staff then held several workshops to determine the best options.

The cost for using Moore Australia was $9,000.

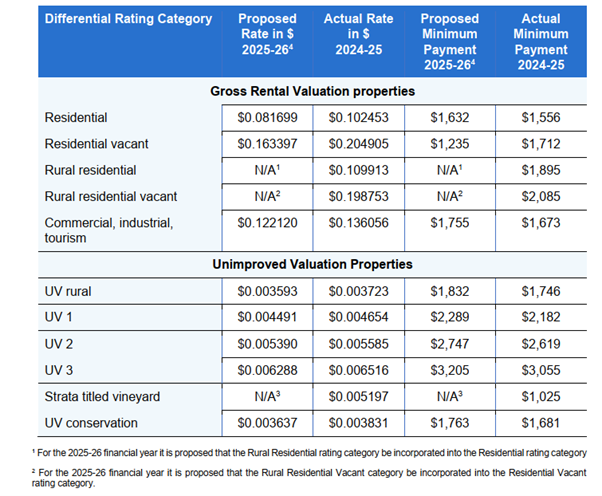

What is the proposed rate in the dollar for each rating category?

The following table summarises the proposed amount for each rating category.