Below is a list of frequently asked questions related to rates.

Please note, we distribute rate notices in the third week of August every year. If your contact details have changed, please let us know by completing the Change of Details form to ensure we send your rates notice to the correct address. You can also sign up for e-rates to receive your notice via email.

General

Rates are a property tax that people pay annually to their local council if they own a house or land. The money helps pay for the services, facilities and infrastructure needed by the community such as roads, parks, rubbish collection, and libraries.

How rates are calculated is set out in Local Government Act 1995 and the Valuation of Land Act 1978.

Rates are the contribution property owners makes towards the services, infrastructure and facilities used by our community, and its many visitors. Rates also help to fund initiatives which protect our region’s unique environment, support community groups and help people of all ages to live an active lifestyle.

More information is provided on the How Rates are Used page.

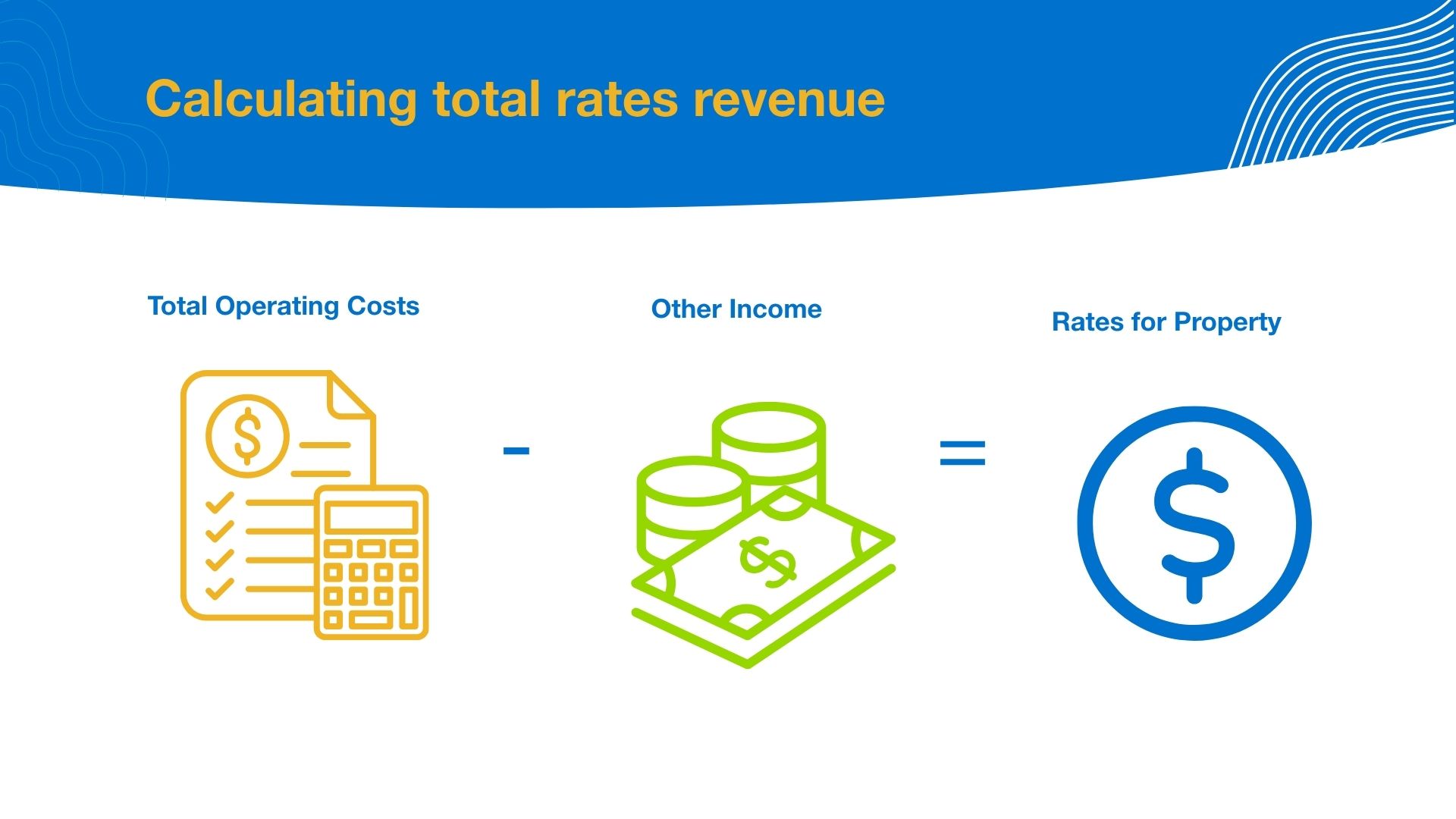

To calculate rates paid by individual property owners, the Shire must first determine the total amount of rates revenue needed. This is done by calculating the total operating costs minus income from other sources such as fees, charges or grant funding. The balance is the total amount of money that must be collected from all property owners in the Shire by charging rates.

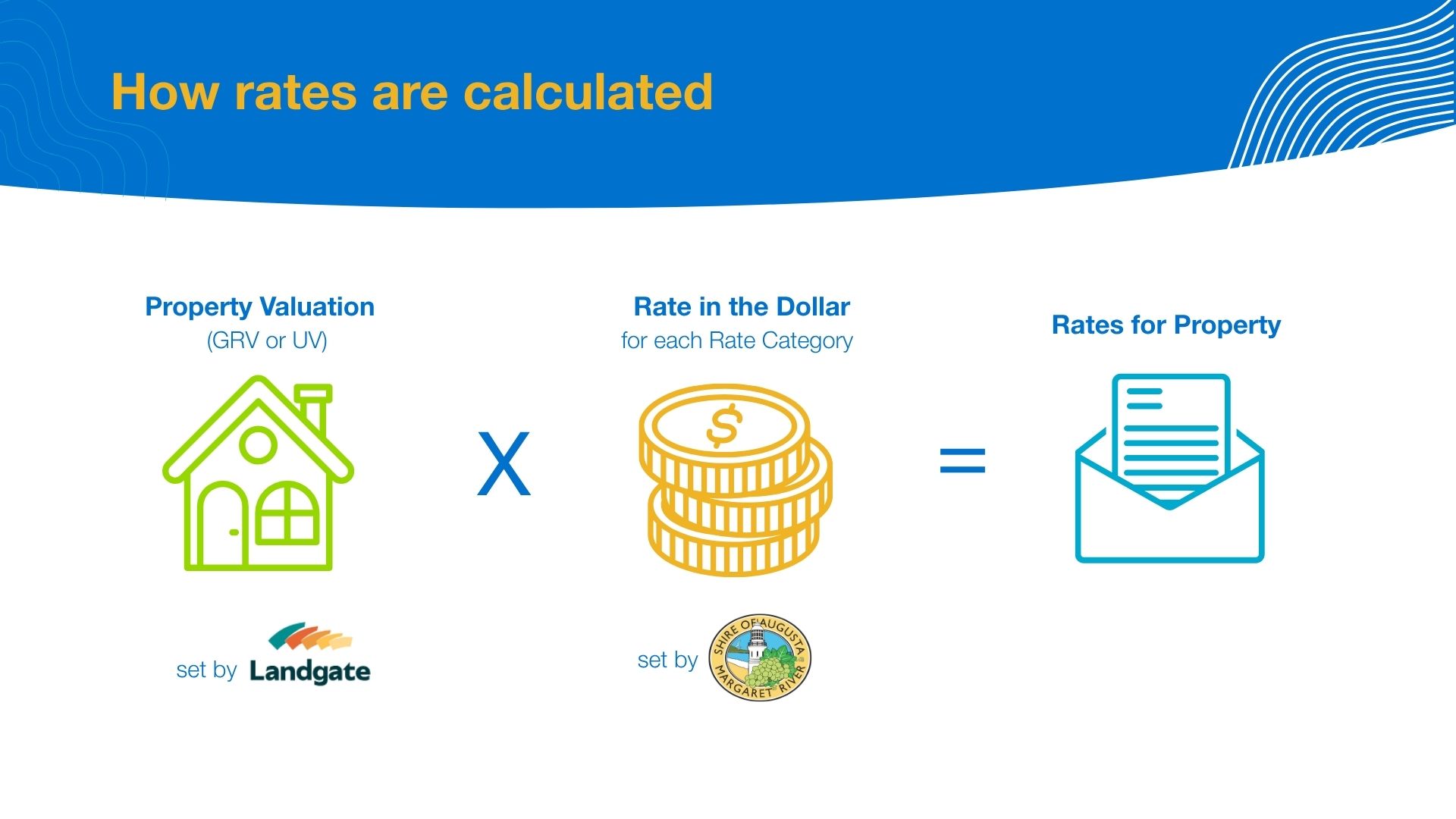

In Western Australia, rates must be calculated by multiplying each property’s valuation multiplied by a differential ‘rate in the dollar’.

Your property’s valuation is determined by Landgate’s Valuer General’s Office, which is a separate organisation to the Shire of Augusta Margaret River. Depending on the predominant use of your property, Landgate will assign your property a ‘Gross Rental Value’ (GRV) or an ‘Unimproved Value’ (UV).

The rate in the dollar is set by council. We use a differential rating system, which means we charge different rates for different property categories, which are based on zoning and land use.

Gross Rental Valuation (GRV) is the yearly income a property might reasonably be expected to generate if it was rented. The amount is influenced by factors such as age, size, date of construction, car shelters and pools.

GRVs are not set by the Shire. They are provided by the Valuer General which is WA’s statutory authority for working out how much land is worth across the state, as per the Valuation of Land Act 1978 (the VLA).

To find out more about GRV, visit landgate.wa.gov.au.

Unimproved Value (UV) is the fair market (sale) value of the property and is used to calculate rates for properties predominantly used for rural purposes. The UV valuation takes into account the value of the land only, and not any improvements on the land such as dwellings or sheds.

We have a tiered rating system for properties on an unimproved valuation. The categories are based on the number of non-rural uses a property has been given Shire approval for (e.g. chalet = 1 non-rural use; chalet and winery = 2 non-rural uses).

- UV Rural - is the general rate that applies to properties with rural, residential and ancillary residential uses. It forms the base for all other UV rates in the dollar.

- UV1 - applies where there is one non rural use and is 25% higher than UV Rural.

- UV2 - applies where there are two non-rural uses and is 50% higher than UV Rural.

- UV3 - applies where there are three or more non rural uses and is 75% higher than UV Rural.

- UV Conservation - applies to properties zoned Bushland Protection, Leeuwin-Naturaliste Ridge Landscape Amenity, Leeuwin-Naturaliste Ridge Conservation and Southern Ocean Foreshore protection. These properties have some usage restrictions and their rating reflects this.

Please note: UV Strata Vineyard is now included in UV Rural.

The Valuer General completes a revaluation of UV properties annually. The most recent valuation was undertaken in August 2024 and will come into effect on 1 July 2025.

We use a differential rating system, which means we charge different rates for different property categories, which are based on zoning and land use. There are differential rating categories for both GRV and UV properties.

See the The Statement of Objects and Reasons document for further information on each of the rating categories

Under State legislation, less than 50% of ratepayers in any differential rating category can be charged the minimum rate.

Some ratepayers may be issued an additional rate notice during the year, referred to as an Interim Rate Notice.

An Interim Rate Notice is a result of changes that have happened to the property which require a rating adjustment to be calculated after you have been issued with the original rate notice.

These notices are required to be issued by the Shire for various reasons such as:

- If Landgate considers that the Gross Rental Value (GRV) of a ratepayers' property has changed

- Subdivision / Strata of land or amalgamation of land

- Improvements or additions to the property including building a new house and, alterations and additions to an existing home including sheds

- Demolition of any improvements

- Addition or removal of rubbish or recycling collection services.

An Interim Rate Notice will be accompanied by a letter of explanation including the details of the reason for the amendment and effective date of the valuation.

Rates make up around 65% of the Shire’s income. To minimise rate payments, we work hard to generate revenue from other sources such as the Rec Centre entry fees and membership and capital grants and contributions.

As part of our ongoing advocacy efforts we’re urging the State and Federal Governments to review the local government funding model. Tourism is vital to our local and state economy, yet funding is based solely on our permanent population and doesn’t consider the extra demand high visitor numbers place on our infrastructure and services. We’re calling for great investment in our shire to maintain quality facilities for residents and visitors alike, and to support our growing role as a destination of choice.

More homes mean more people using Shire services like libraries and recreation centres. Additionally, the Shire inherits the costs of maintaining infrastructure such as new roads, footpaths, and parks. For example, between 2023 and 2025, the Shire has taken on $27.9 million worth of developer-built assets, all of which require ongoing maintenance and eventual renewal by the Shire.

Paying your rates

Rate Notices are issued in the third week of August each year.

If your contact details have changed, please let us know by completing the Change of Details form so we can send your rates notice to the correct address.

In addition to your rates, you may find several charges on your rates notices including:

-

Emergency Services Levy

-

Waste facilities maintenance rate

-

Waste charges including Rubbish and/or recycling collection fees.

-

Swimming pool fee*

-

Cost of recovery of rates*

-

Penalty interest*

Emergency Services Levy (ESL)

The Emergency Services Levy (ESL) is an amount set by the Department of Fire and Emergency Services which we collect on their behalf. All ESL funds collected via our rates are passes in full to DFES and funds Western Australia’s fire and emergency services, including Career and Volunteer Fire & Rescue Service brigades. For more information visit the DFES website.Waste Collection Charge

In accordance with the Waste and Recovery Resources Act 1997 (WARRS Act), the Shire is required to levy waste collection charges. An annual waste collection fee is applied to residential properties, covering the standard three-bin kerbside service introduced in July 2019. This includes a 140L landfill bin, a 240L recycling bin, and a 240L Food Organics and Garden Organics (FOGO) bin.

Additional charges may apply based on specific property needs or requested services.

For more information, please visit the Waste Services website.

Waste Facilities Maintenance Rate

All rateable properties within the Shire regardless of land use or characteristics are subject to the Waste Facilities Maintenance Rate for waste management operations including the Davis Rd landfill facility and waste transfer stations provided to ratepayers across the shire.

All revenue raised from this levy is exclusively used to fund:

• Upgrades and improvements at the Davis Road landfill site

• Maintenance and operations of waste transfer stations throughout the Shire

• Long-term enhancements to ensure efficient and sustainable waste management practices

The Shire is legally required to use this revenue for waste management purposes, in line with statutory obligations, and to ensure the sustainability of these services into the future.

Swimming Pool Inspection Fee

If you have a swimming pool or spa you will be charged an annual fee which is a contribution towards the cost of mandatory pool inspections, which are required every four years as per State legislation.

This fee is listed in the Shire's Schedule of Fees and Charges. For more information, please contact our Building Services on (08) 9780 5255.

Recovery of Rates

These costs arise from the Shire undertaking debt recovery processes, which may include legal action against property owners who fail to pay their annual rates by the due dates. Under the Local Government Act 1995 (WA), all costs associated with the recovery of unpaid rates are recoverable from the ratepayer. These recovery costs will appear on the Rate Notice as legal fees.

If you are a pensioner or senior, you can apply to receive a State Government Rebate on charges for local government rates and Emergency Services Levies (ESL).

To find out more go to Rates Rebates and Concessions.

If you believe the differential rating category shown on your rate notice is incorrect, you will need to tell us in writing by emailing [email protected]

An example of an incorrect rating may be:

- My property is rated Tourism but I didn’t renew my holiday house approval or it has lapsed and I now live in the house permanently

- My property is rated Industrial and I have now demolished the workshop and no longer operate a business from the property

- My property is rated UV 1, UV2 or UV 3 and I am no longer operating a non- rural use on this land.

Your valuation (GRV or UV) is only one factor used to calculate your rates notice. The Valuation of Land Act 1978 (as amended) Part IV sets out the manner in which valuation objections and appeals may be lodged. A property owner may lodge an objection against the valuation of a property within 60 days of the date of issue of a rate notice.

For information on how your values are calculated and how to lodge an objection, please visit landgate.wa.gov.au/valuations, or alternatively call Landgate Customer Service on (08) 9273 7373.

Section 6.76 of the Local Government Act 1995 provides the grounds, time and the way individual objections and appeals to the Rates Record may be lodged. An objection to the Rate Book must be made in writing to the council within 42 days of the date of issue of a rates notice.

Section 6.81 of the Local Government Act 1995 refers that rates assessments are required to be paid by the due date, regardless of whether an objection or appeal has been lodged. In the event of a successful objection or appeal, the rates will be adjusted, and you will be advised accordingly. Credit balances will be refunded on request.

There are only two reasons under the Local Government Act which allow for an objection to paying rates:

- You are not the ratepayer. Which means you are not the owner of the rateable property; and

- The property is non rateable as per the Section 6.26 of the Local Government Act, which requires approval of the Council.

Unless either of these two criteria are met, there is a legal obligation to pay the debt to the Shire.

Interest is charged on outstanding amounts.

There is no fee for paying your rates in installments however you will be charged 4.9% interest.

Failure to make the third or fourth payments by the due date will result in the cancellation of any payment arrangement in place and the remaining balance of your Rates Notice will then be due in full.

Any amounts outstanding after the due date may be recovered by legal action. Any legal action undertaken by Council may result in additional expenses being incurred by the ratepayer.

Eligible pensioners are exempt from additional charges on their rebate portion only. The rebate is funded by the Government of Western Australia.

The Shire will follow the Debt Recovery Procedure to recover the monies due, where rates, service and waste charges remain unpaid after the due dates. Legal action will be progressed through a debt recovery firm. All costs associated with the process of legal action are recoverable from the ratepayer and will be added to the rates account.

If you are having trouble paying, contact the Revenue Team as early as possible to negotiate a payment plan to avoid the Shire commencing legal action.

Once legal action is instructed, it will immediately register a default in your credit rating, and a General Procedure Claim (GPC) will be served against you for the debt including the appropriate legal costs. In the case of multiple owners this affects all owners.

Please note, even if you pay between the legal instruction date and the time it takes for the bailiff to serve the GPC document to you, you will incur legal fees and a default in credit rating.

Paying by the due dates will ensure interest is not charged on overdue amounts.

If the exact amount of the rates first instalment was not paid in full (in one transaction) by the due date, the owner will not have automatically been placed on the instalment option.

Please contact the Revenue Team on (08) 9780 5234 or [email protected].

If you are experiencing financial hardship, please call the Shire on 9780 5255 or [email protected] to discuss your eligibility for the Shire's Financial Hardship Policy.

The Shire's Revenue Team can provide more information on:

- How your property rates are calculated

- The fees and charges component of your rate notice

- Differential rate categories – GVR and UV codes

- What to do if you feel any of the above are incorrect.

The Shire's Revenue Team can be contact on (08) 9780 5234.

Visit the Landgate website or call (08) 9273 7373 if you are seeking more information about:

- How property valuations are calculated

- What to do if you feel the valuation of your property is incorrect.

Contact your local Councillor if you want to discuss or are seeking further information about:

- The amount rates have increased from the previous year

- How rates and the long term financial plan correlate

- How the money collected from rates is spent within the Shire and in the community.

Go to Your Councillors

Yes - please complete our Special Arrangement form.

Payments can be made on a weekly, fortnightly basis.

Please note that all payment arrangements are subject to interest.

Under the Local Government Act, all owners are jointly and severally responsible for the payment of the rates and service charges. If each owner requires their own copy of the rate notice, please contact the Shire's Revenue Team.

It is the responsibility of the owner to advise the Shire when a change of address takes place that would prevent the effective service of the Rates Notice.

Please notify Council of your change of residential and/or mailing address by completing the Change of Details page.

Rates in 2025-26

UV valuations across our shire have increased by 9%.

GRV valuations across our shire have increased 31%, which aligns with the current rental market conditions.

If the increase in GRV and UV property values set by the Valuer General were passed directly on to ratepayers, the Shire’s overall rates revenue would increase by 28%, funded entirely by ratepayers through increases in their rates bills.

To offset the impact of the higher property values Council is being asked to consider reducing the differential rates in the dollar (the different rate amounts applied to each property type).

While rising operational costs mean we can’t fully absorb the increase, we’ve done our best to keep rate increases as modest as possible.

The increase per property will depend on the type of property you own and how much your individual property valuation (GRV or UV) has changed.

For the average residential household, the increase in rates will be around $2.83 a week, or $148 a year

We have also made some changes to our rating categories to bring them in line with the current legislation and streamline the administrative process, which could impact your rates. Also see rates review.

| Differential Rating Category | Rate in $ 2025-26 |

Minimum Payment 2025-26 |

| GROSS RENTAL VALUATION PROPERTIES | ||

| Residential | $0.081699 | $1,632 |

| Residential vacant | $0.163397 | $1,235 |

| Commercial, industrial, tourism | $0.122120 | $1,755 |

| UNIMPROVED VALUATION PROPERTIES | ||

| UV rural | $0.003593 | $1,832 |

| UV 1 | $0.004491 | $2,289 |

| UV 2 | $0.005390 | $2,747 |

| UV 3 | $0.006288 | $3,205 |

| UV conservation | $0.003637 | $1,763 |

The Shire’s overall rates revenue increasing by 4.9% which is the minimum amount needed to meet rising operational costs and ensure we can continue to fund the essential services our community expects and deserves. This 4.9% is on top of additional rates revenue generated from additional properties created during the past twelve months.

Rating review

The Shire of Augusta Margaret River has been working to improve our rating structure so it is simpler and fairer for everyone who lives in or does business in our community. We also want our rating system to better align with State government legislation and guidelines to streamline administrative processes.

The rating review will be implemented in ‘two-phases’ with the first phase of changes proposed to take effect as part of the 2025-26 rating year. Phase Two recommendations are proposed to be investigated further during 2025-26 for implementation in future rating years.

We’ve reduced the number of rating categories and made some changes to the minimum payment for Residential Vacant rating category in line with the Local Government Act 1995.

The new rating categories are shown below

| 2025-26 Rating categories | 2024-2025 Rating categories |

| Residential | Residential Rural Residential |

| Residential vacant | Residential Vacant Rural Residential Vacant |

| Industrial, commercial, tourism | Industrial, commercial, tourism |

| UV rural | UV Rural UV Strata Titled Vineyard |

| UV 1 | UV 1 |

| UV 2 | UV 2 |

| UV 3 | UV 3 |

| UV Conservation | UV Conservation |

Implementing a split rating system is complex and resource-intensive, requiring both an additional FTE and support from Landgate—who have advised they won’t have capacity to provide indicative property values until at least 2026–27.

Any future changes to the rating of short-term rental accommodation would require further consultation and Council workshops, and if pursued, would not take effect before the 2026–27 rating year.

Currently, properties that have planning approval to operate as an unhosted short-term holiday rental are included in the Commercial, Industrial, Tourism rating category. The rate in the dollar for Commercial, Industrial, Tourism category is already higher than the rate in the dollar for residential properties. That is, residential = $0.081699 versus Industrial, commercial, tourism =$0.12212.

As part of ongoing rate review we will explore how hosted holiday homes are rated to ensure we level the playing field and keep things fair for everyone.

The cost for using Moore Australia was $9,000.